The

ULTIMATE

ULTIMATE online checking account

Simple. Seamless. Smart.

Already have an account? Log in

21

years of banking innovation

33

million customers served

07

days a week live customer support

90

thousand retail deposit locations

No monthly fees

with eligible direct deposit, otherwise $5 per month** Monthly fee waived whenever you receive a payroll or government benefits direct deposit in the previous monthly statement period. Otherwise $5 per month.

No hidden fees

No minimum balance required

to open an account online** The GO2bank account comes with a Visa Debit card. If you open an account online, there is no fee or minimum balance requirement. If you open an account by getting a GO2bank debit card in a store, then there is a purchase fee and an initial deposit of $20 - $500 required.

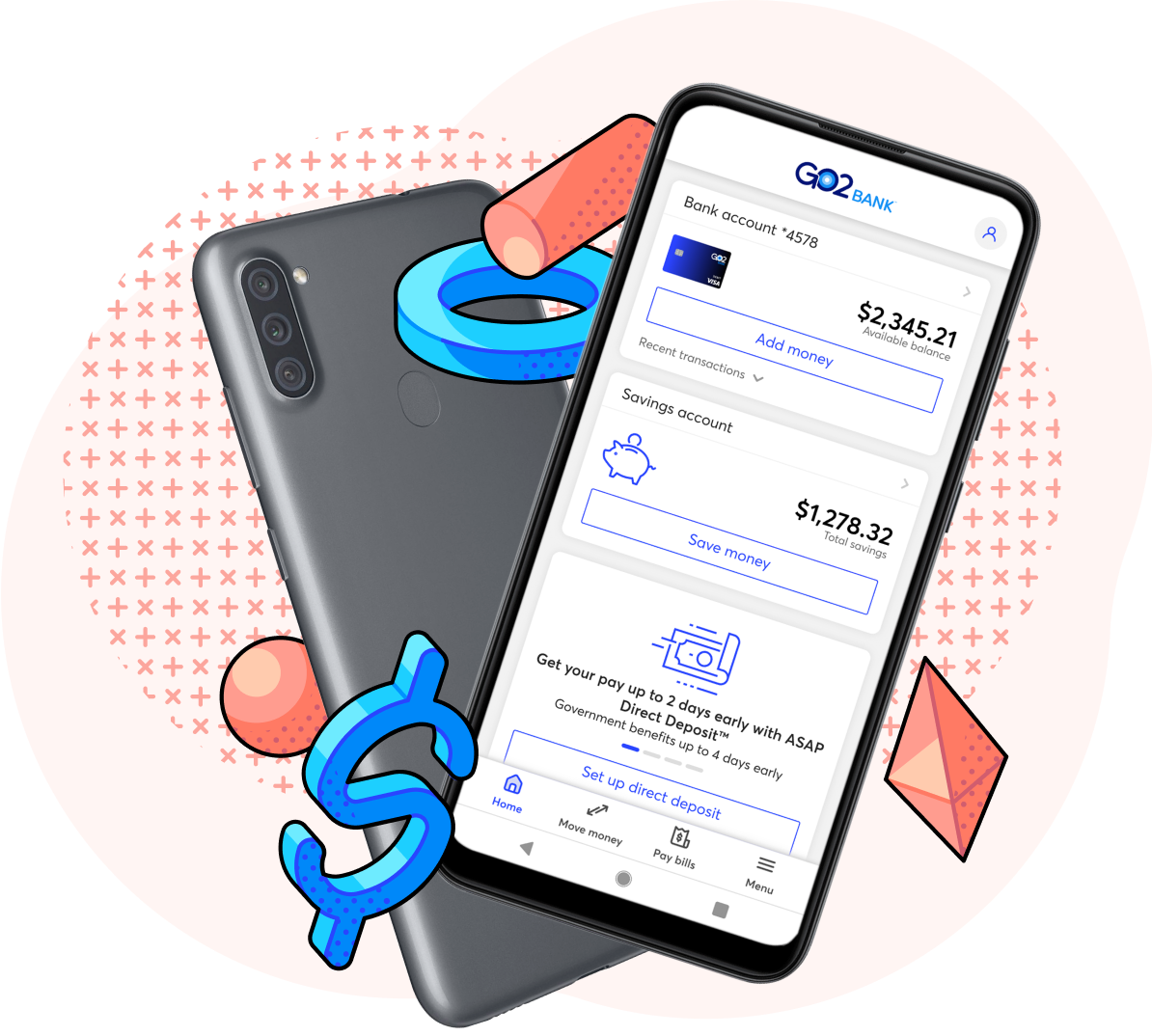

Download the GO2bankTM mobile app

Pay your bills from a single app – even send a check to make a payment!

Find free ATM locations near you** See app for free ATM locations. $3 for out-of-network withdrawals, plus any additional fees the ATM owner or bank may charge. Limits apply.

Lock & unlock your card with a tap for added security** Previously authorized transactions and deposits/transfers to your account will function with a locked card.

Overdraft protection up to $200

with opt-in and eligible direct deposit** Opt-in required. Account must have initial eligible direct deposits, must be in good standing and have an activated chip-enabled debit card to opt-in. Ongoing eligible direct deposits and other criteria apply to maintain eligibility for overdraft protection. Only debit card purchase transactions are eligible for overdraft protection and overdrafts are paid at our discretion. We reserve the right to not pay overdrafts. For example, we may not pay overdrafts if the account is not in good standing, or is not receiving ongoing eligible direct deposits, or has too many overdrafts. Overdraft fees may cause your account to be overdrawn by an amount that is greater than your overdraft coverage. A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid a fee. Learn more (Overdraft Protection PDF).

We'll automatically cover purchase transactions that exceed your available balance

Get your pay up to 2 days early

with direct deposit** Early direct deposit availability depends on payor type, timing, payment instructions, and bank fraud prevention measures. As such, early direct deposit availability may vary from pay period to pay period. The name and Social Security number on file with your employer or benefits provider must match your GO2bank account to prevent fraud restrictions on the account.

Get your government benefits up to 4 days early.

Plus, direct deposit unlocks exclusive perks!

Free Samsung Galaxy Smartphone with direct deposit of $200 or more

when you pay for 2 months of wireless service.**

See order page for terms.

Receive a payroll or government benefits direct deposit by 3/15/22 to be eligible.

Deposit cash at a local retailer

Use your card or the app to deposit cash at retailers nationwide** Retail service fee up to $4.95 and limits apply.

Transfer money to your GO2bank account

Move money from a linked debit card** Fees and limits apply to debit card transfers. See Deposit Account Agreement (PDF) or bank account** See Deposit Account Agreement (PDF) to GO2bank

Cash a check from the comfort of home

Get your money in minutes or in 10 days. Just snap a pic with your mobile device.** Activated, chip-enabled debit card required to use Ingo Money check cashing service. The check cashing service is provided by Ingo Money, Inc. and the sponsor bank, identified in the terms and conditions for the service and subject to Ingo Money Inc. Terms and Conditions and Privacy Policy. Limits apply. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money's sole discretion. Fees apply for approved Money in Minutes transactions funded to your account. Unapproved checks will not be funded to your account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See Deposit Account Agreement (PDF) for details. Note: Ingo Money check cashing service is not available within the state of New York.

Free nationwide ATM network** See app for free ATM locations. $3 for out-of-network withdrawals, plus any additional fees the ATM owner or bank may charge. Limits apply.

Find free ATM locations using the app

Earn up to 7% instant cash back

when you buy eGift Cards from nearly 100 popular merchants in the app** Activated, chip-enabled debit card required to purchase eGift Cards. Active GO2bank account required to receive eGift Cards. eGift Card merchants subject to change. See Deposit Account Agreement (PDF) for details.

Earn over 10x the national savings rate average

High-yield savings account, 2.50% APY paid quarterly on savings up to $5,000.** Interest paid quarterly on the average daily balance of all savings during the quarter up to a $5,000 average daily balance and if the account is in good standing. Fees on your primary deposit account may reduce earnings on your savings account. 4.50% Annual Percentage Yield (APY) and 4.41% interest rate are accurate as of (December 2024). APY and interest rate may change before or after you open an account. See Deposit Account Agreement (PDF) for terms and conditions. The national deposit rate for savings accounts is used when stating GO2bank savings accounts “Earn well over the national savings rate average”. Visit https://www.fdic.gov/regulations/resources/rates/ to learn more.

Deposit cash at a local retailer

Use your card or the app to deposit cash at retailers nationwide** Retail service fee up to $4.95 and limits apply.

Transfer money to your GO2bank account

Move money from a linked debit card** Fees and limits apply to debit card transfers. See Deposit Account Agreement (PDF) or bank account** See Deposit Account Agreement (PDF) to GO2bank

Cash a check from the comfort of home

Get your money in minutes or in 10 days. Just snap a pic with your mobile device.** Activated, chip-enabled debit card required to use Ingo Money check cashing service. The check cashing service is provided by Ingo Money, Inc. and the sponsor bank, identified in the terms and conditions for the service and subject to Ingo Money Inc. Terms and Conditions and Privacy Policy. Limits apply. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money's sole discretion. Fees apply for approved Money in Minutes transactions funded to your account. Unapproved checks will not be funded to your account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See Deposit Account Agreement (PDF) for details. Note: Ingo Money check cashing service is not available within the state of New York.

Free nationwide ATM network** See app for free ATM locations. $3 for out-of-network withdrawals, plus any additional fees the ATM owner or bank may charge. Limits apply.

Find free ATM locations using the app

Earn up to 7% instant cash back

when you buy eGift Cards from nearly 100 popular merchants in the app.** Activated, chip-enabled debit card required to purchase eGift Cards. Active GO2bank account required to receive eGift Cards. eGift Card merchants subject to change. See Deposit Account Agreement (PDF) for details.

Earn up to 7% instant cash back

when you buy eGift Cards from nearly 100 popular merchants in the app** Activated, chip-enabled debit card required to purchase eGift Cards. Active GO2bank account required to receive eGift Cards. eGift Card merchants subject to change. See Deposit Account Agreement (PDF) for details.

Earn over 10x the national savings rate average

High-yield savings account, 2.50% APY paid quarterly on savings up to $5,000.** Interest paid quarterly on the average daily balance of all savings during the quarter up to a $5,000 average daily balance and if the account is in good standing. Fees on your primary deposit account may reduce earnings on your savings account. 4.50% Annual Percentage Yield (APY) and 4.41% interest rate are accurate as of (December 2024). APY and interest rate may change before or after you open an account. See Deposit Account Agreement (PDF) for terms and conditions. The national deposit rate for savings accounts is used when stating GO2bank savings accounts “Earn well over the national savings rate average”. Visit https://www.fdic.gov/regulations/resources/rates/ to learn more.

Earn over 10x the national savings rate average** Interest paid quarterly on the average daily balance of all savings during the quarter up to a $5,000 average daily balance and if the account is in good standing. Fees on your primary deposit account may reduce earnings on your savings account. 4.50% Annual Percentage Yield (APY) and 4.41% interest rate are accurate as of (December 2024). APY and interest rate may change before or after you open an account. See Deposit Account Agreement (PDF) for terms and conditions. The national deposit rate for savings accounts is used when stating GO2bank savings accounts “Earn well over the national savings rate average”. Visit https://www.fdic.gov/regulations/resources/rates/ to learn more.

High-yield savings account, 1% APY paid quarterly on savings up to $5,000** Interest paid quarterly on the average daily balance of all savings during the quarter up to a $5,000 average daily balance and if the account is in good standing. Fees on your primary deposit account may reduce earnings on your savings account. 4.50% Annual Percentage Yield (APY) and 4.41% interest rate are accurate as of (December 2024). APY and interest rate may change before or after you open an account. See Deposit Account Agreement (PDF) for terms and conditions. The national deposit rate for savings accounts is used when stating GO2bank savings accounts “Earn well over the national savings rate average”. Visit https://www.fdic.gov/regulations/resources/rates/ to learn more..

Keep the money in your account safe** Funds are protected from unauthorized transactions on successfully activated cards. Prompt notice is required.

Build or repair your credit with the GO2bank Secured Visa® Credit Card** Available only to GO2bank accountholders with direct deposits totaling at least $100 in the past 30 days. Eligibility criteria applies. Other fees apply.

- No credit check to apply

- No annual fee

- Credit limit starting as low as $100** Available only to GO2bank accountholders with direct deposits totaling at least $100 in the past 30 days. Eligibility criteria applies. Other fees apply.

- Payment behavior is reported to 3 credit bureaus

Need a card today?

Pick up a GO2bank Visa® Debit Card at a retail store near you** The GO2bank account comes with a Visa Debit card. If you open an account online, there is no fee or minimum balance requirement. If you open an account by getting a GO2bank debit card in a store, then there is a purchase fee and an initial deposit of $20 - $500 required.

Pick up a GO2bank Visa® Debit Card at a retail store near you** The GO2bank account comes with a Visa Debit card. If you open an account online, there is no fee or minimum balance requirement. If you open an account by getting a GO2bank debit card in a store, then there is a purchase fee and an initial deposit of $20 - $500 required.

Refer a friend, and you both get $50** In order for both the referred individual and the referring GO2bank accountholder to each qualify for and receive the $50 referral reward, the following conditions must be met: The referred individual may not have previously opened a GO2bank Deposit Account ("Account"); they must open a new Account by December 31, 2025; they must open the new account using the referring GO2bank accountholder's unique referral (share) link directly or as shared through email or social post; and they must receive in the new Account a qualifying direct deposit of $200 or more within 45 days of account opening. The qualifying direct deposit must be made by the referred individual's employer, payroll provider, government benefits, or unemployment benefits payor by Automated Clearing House (ACH) deposit. Bank ACH transfers, debit card transfers, verification or trial deposits from financial institutions, tax refund deposits, mobile check cashing, and cash deposits are not qualifying deposit activities. Referring GO2bank accountholder and referred individual GO2bank accounts must both be in good standing to be eligible for and receive a reward. The reward is paid to each party within 48 hours after qualifying funds are first deposited into the referred individual's new Account. New and referring GO2bank accountholders may earn no more than $1,500 in referral rewards across all Refer a friend campaigns per calendar year (January 1 - December 31). Referred individual acknowledges that payment of the reward will result in the referring GO2bank accountholder's knowledge of the individual's new Account. GO2bank reserves the right to cancel or modify the terms of the referral reward offer or terminate the member's eligibility at any time with or without prior notice. All referral rewards will be reported on form 1099 to the IRS.

Both you and your friend get $50 when they open a new GO2bank account and receive a qualifying direct deposit

Simple. Seamless. Smart.

See how GO2bank compares with other mobile accounts** Comparison chart may not be representative of most mobile bank offerings.

Mobile account A

Uses a 3rd party bank** Product issued by third party bank, who is a Member FDIC.

Mobile account B

Uses a 3rd party bank** Product issued by third party bank, who is a Member FDIC.

No monthly fees with eligible direct deposit, otherwise $5 per month** Monthly fee waived whenever you receive a payroll or government benefits direct deposit in the previous monthly statement period. Otherwise $5 per month.

No monthly fee

$5 with eligible direct deposit

Overdraft protection up to $200 with opt-in and eligible direct deposit** Opt-in required. Account must have initial eligible direct deposits, must be in good standing and have an activated chip-enabled debit card to opt-in. Ongoing eligible direct deposits and other criteria apply to maintain eligibility for overdraft protection. Only debit card purchase transactions are eligible for overdraft protection and overdrafts are paid at our discretion. We reserve the right to not pay overdrafts. For example, we may not pay overdrafts if the account is not in good standing, or is not receiving ongoing eligible direct deposits, or has too many overdrafts. Overdraft fees may cause your account to be overdrawn by an amount that is greater than your overdraft coverage. A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid a fee. Learn more (Overdraft Protection PDF).

Up to $200

Up to $10

Free ATM network** See app for free ATM locations. $3 for out-of-network withdrawals, plus any additional fees the ATM owner or bank may charge. Limits apply.

Early access to your pay** Early direct deposit availability depends on payor type, timing, payment instructions, and bank fraud prevention measures. As such, early direct deposit availability may vary from pay period to pay period. The name and Social Security number on file with your employer or benefits provider must match your GO2bank account to prevent fraud restrictions on the account.

Cash checks with the app** Activated, chip-enabled debit card required to use Ingo Money check cashing service. The check cashing service is provided by Ingo Money, Inc. and the sponsor bank, identified in the terms and conditions for the service and subject to Ingo Money Inc. Terms and Conditions and Privacy Policy. Limits apply. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money's sole discretion. Fees apply for approved Money in Minutes transactions funded to your account. Unapproved checks will not be funded to your account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See Deposit Account Agreement (PDF) for details. Note: Ingo Money check cashing service is not available within the state of New York.

Lock and unlock your card** Previously authorized transactions and deposits/transfers to your account will function with a locked card.

Earn up to 7% cash back when you buy eGift Cards in the app** Activated, chip-enabled debit card required to purchase eGift Cards. Active GO2bank account required to receive eGift Cards. eGift Card merchants subject to change. See Deposit Account Agreement (PDF) for details.

Personalized rewards

Pay bills from a single app

Build your credit with a secured credit card** Available only to GO2bank accountholders with direct deposits totaling at least $100 in the past 30 days. Eligibility criteria applies. Other fees apply.

High-yield savings account** Interest paid quarterly on the average daily balance of all savings during the quarter up to a $5,000 average daily balance and if the account is in good standing. Fees on your primary deposit account may reduce earnings on your savings account. 4.50% Annual Percentage Yield (APY) and 4.41% interest rate are accurate as of (December 2024). APY and interest rate may change before or after you open an account. See Deposit Account Agreement (PDF) for terms and conditions. The national deposit rate for savings accounts is used when stating GO2bank savings accounts “Earn well over the national savings rate average”. Visit https://www.fdic.gov/regulations/resources/rates/ to learn more.

Link your debit card to preferred merchants with Way2PayTM** Easily link your GO2bank debit card to be your payment of choice to shop with 50+ online retailers and pay monthly subscriptions. GO2bank uses Q2 software, Inc. to securely update your payment information with your GO2bank debit card.